Requesting a Loan

This section is about our Instant Loans offer. For info about custom quotes, go to Tailored Deals.

Zharta allows NFT holders to borrow ETH instantly by using NFTs as collateral.

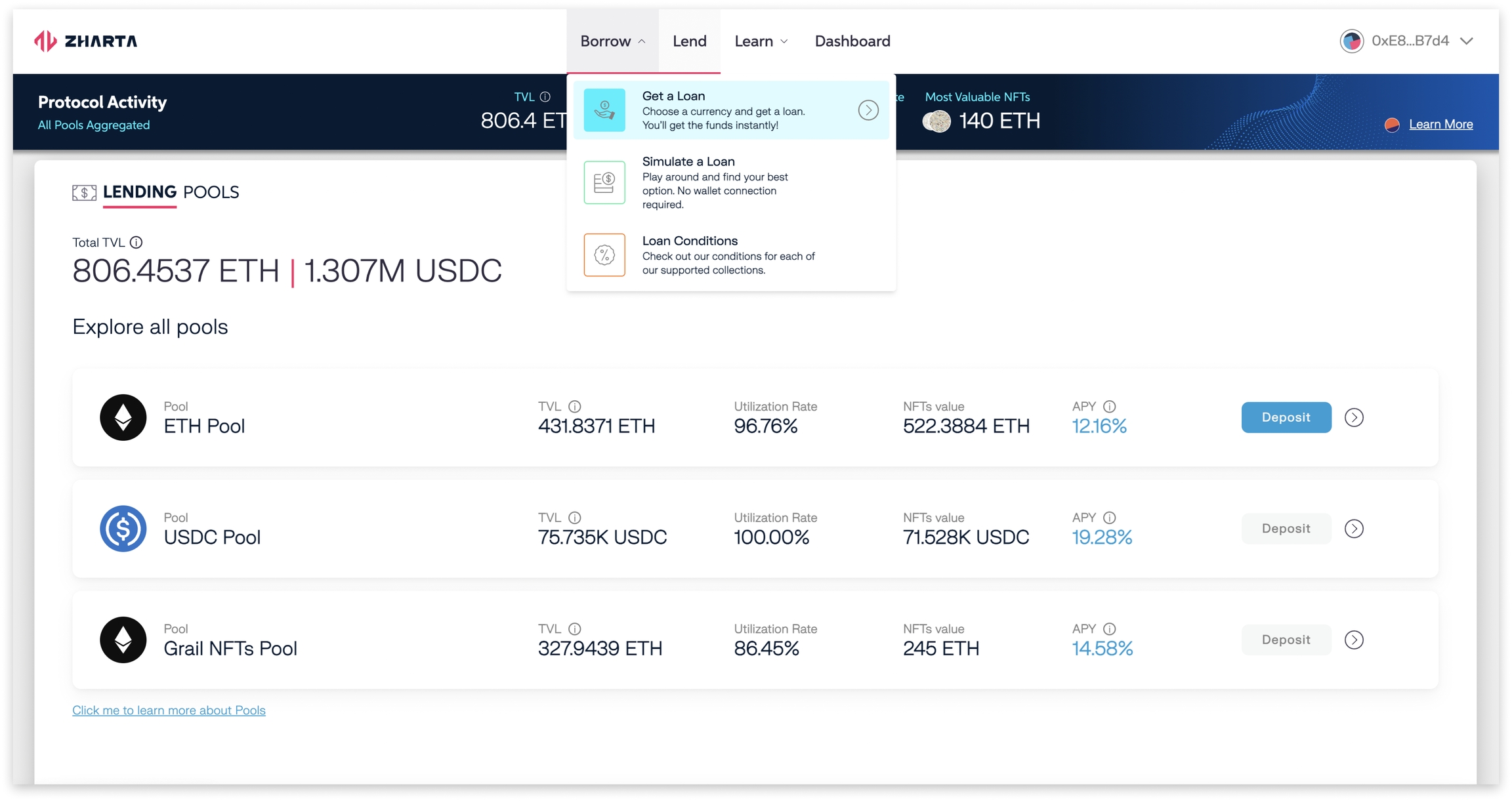

Borrowers can check what conditions their NFTs are eligible for by going to Simulate a Loan (no Wallet connection required) or to Get a Loan (this route makes it easier to check the conditions available for your NFTs specifically, but you'll need to connect your Wallet).

Our instant loans are made possible by our permissionless protocol and liquidity pools. Not having to wait for Lenders to provide liquidity for each individual loan ensures a completely seamless process for Borrowers.

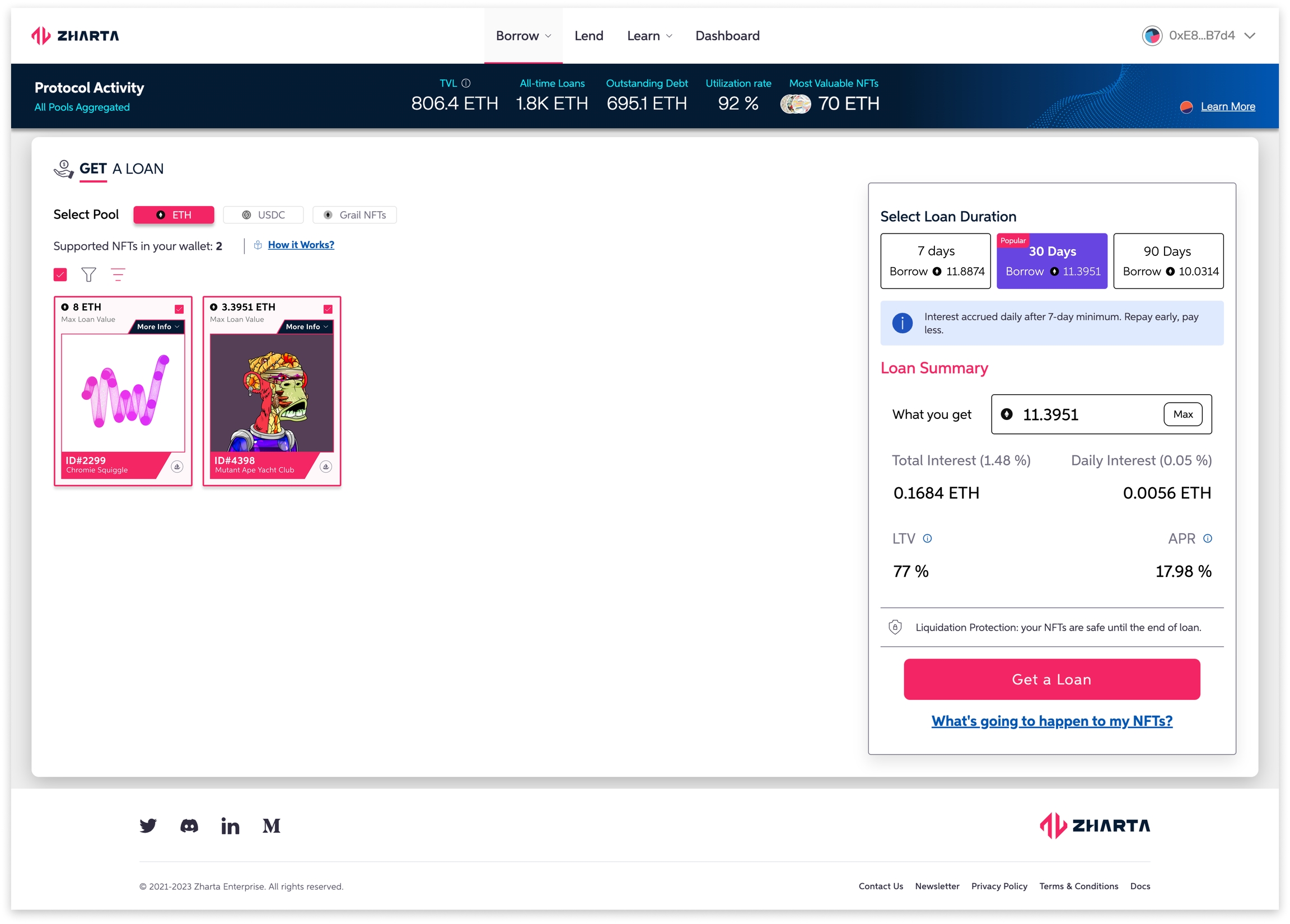

Pro Tip: Borrowers can bundle NFTs, including those from different collections, into a single Loan

Using multiple NFTs as collateral for a single loan increases the amount you can borrow at once, improving gas efficiency.

The currently supported collections are listed here.

Creating a Loan: Step-by-Step Tutorial

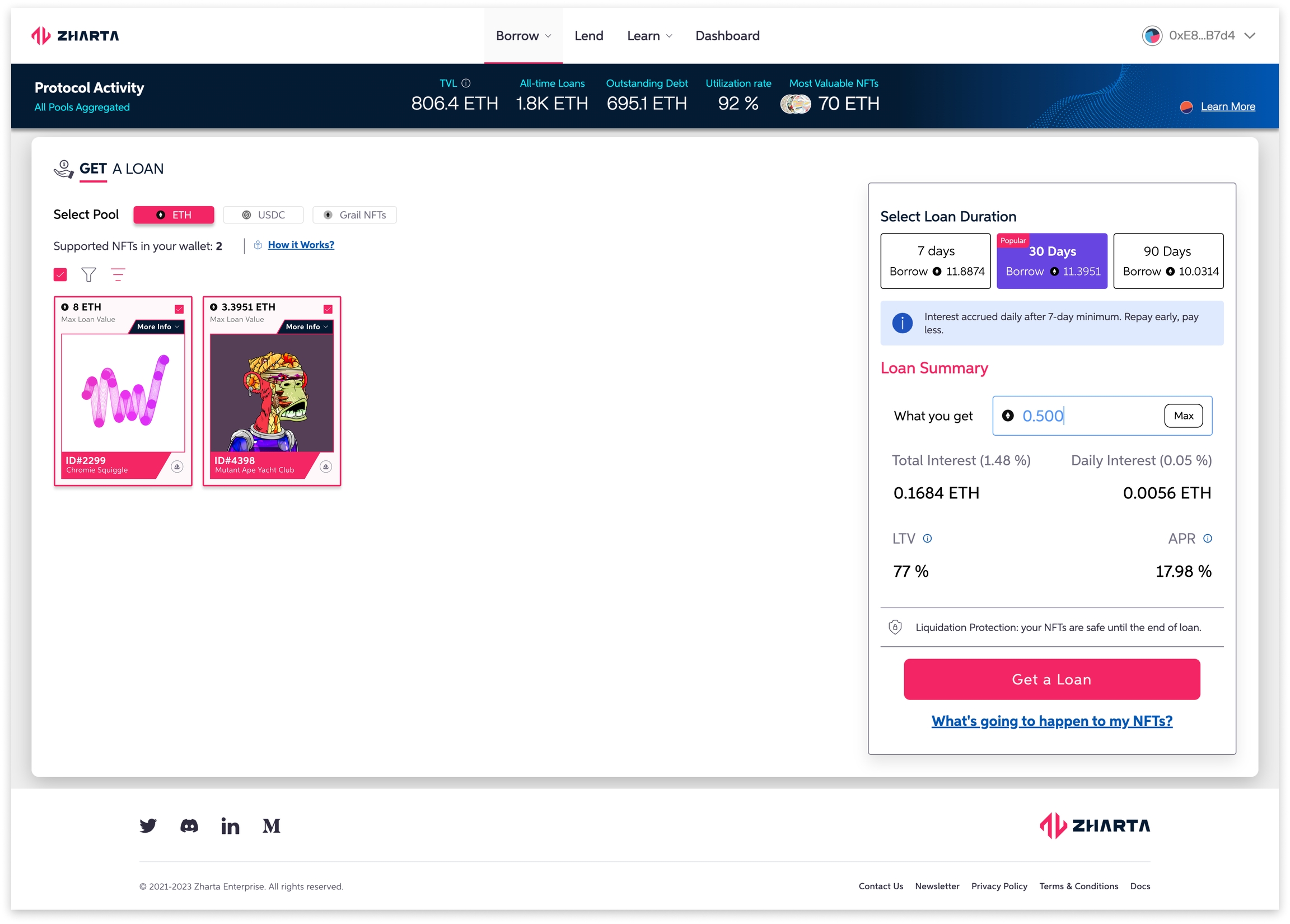

Start by going to the Borrow page.

Here, you'll be able to see which of your NFTs can be used as collateral (you can also view these in your Dashboard). Select the NFTs you want to use for your loan.

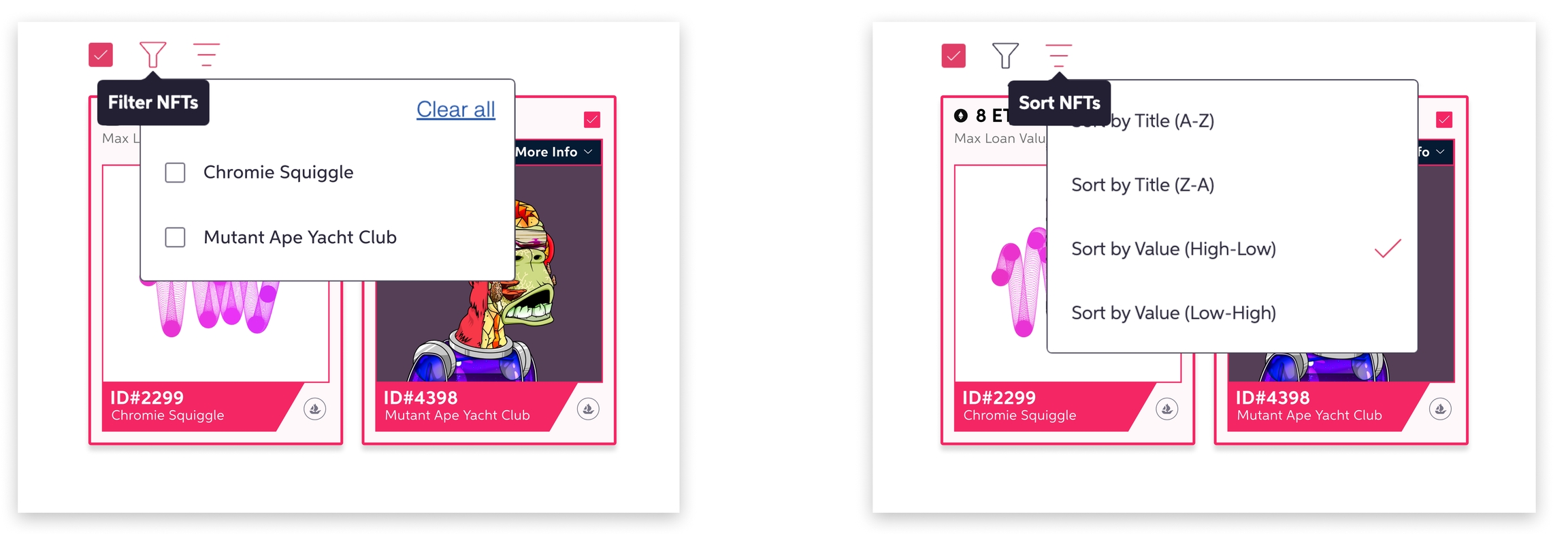

If you have a lot of supported NFTs, you can use our filters to sort through them more easily

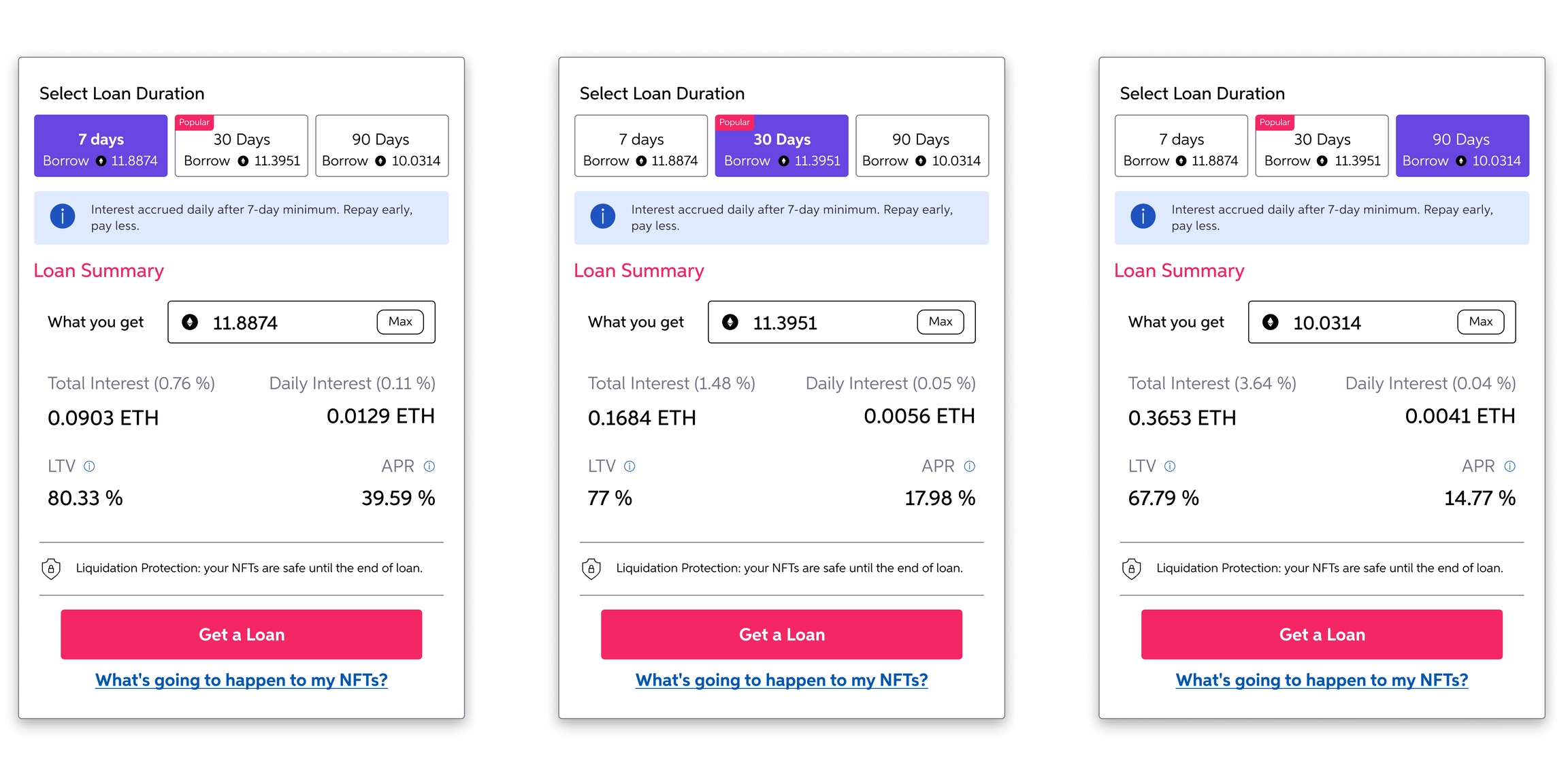

You can choose between 3 loan terms - each with its own LTVs and APRs. You can check the conditions for each collection/loan term here, but a good rule of thumb is that the shorter the term, the higher the LTVs and APRs.

As you might have noticed in the earlier steps, the loan principal automatically changes to the max you can borrow depending on the selected NFTs and loan period.

Once you’ve settled on the collateral and loan term you want, you can adjust this value manually.

When you're done, double-check the loan summary. If everything looks good, click Get a Loan.

This begins the approvals phase.

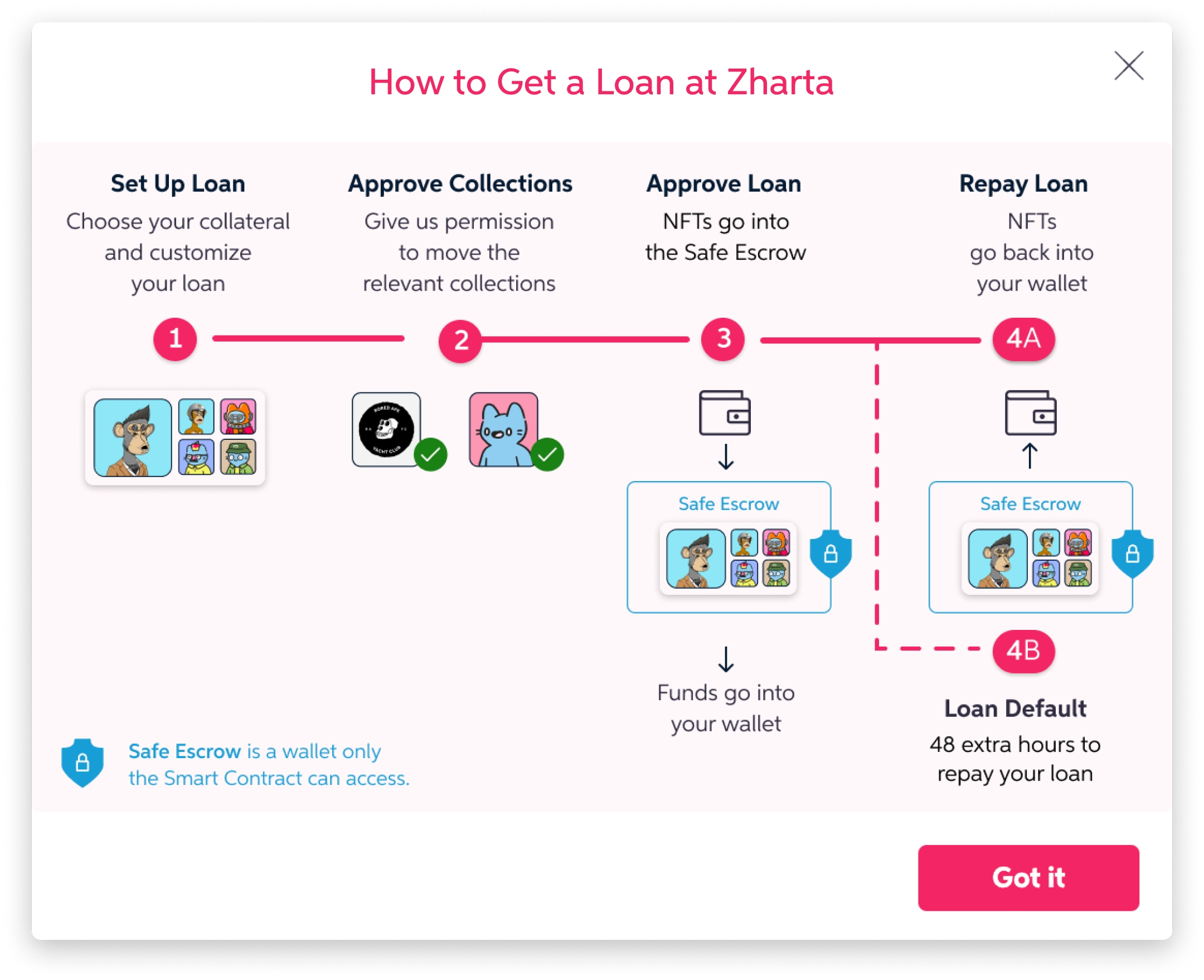

First, you’ll get an overview of the entire process – from setting up to repayment.

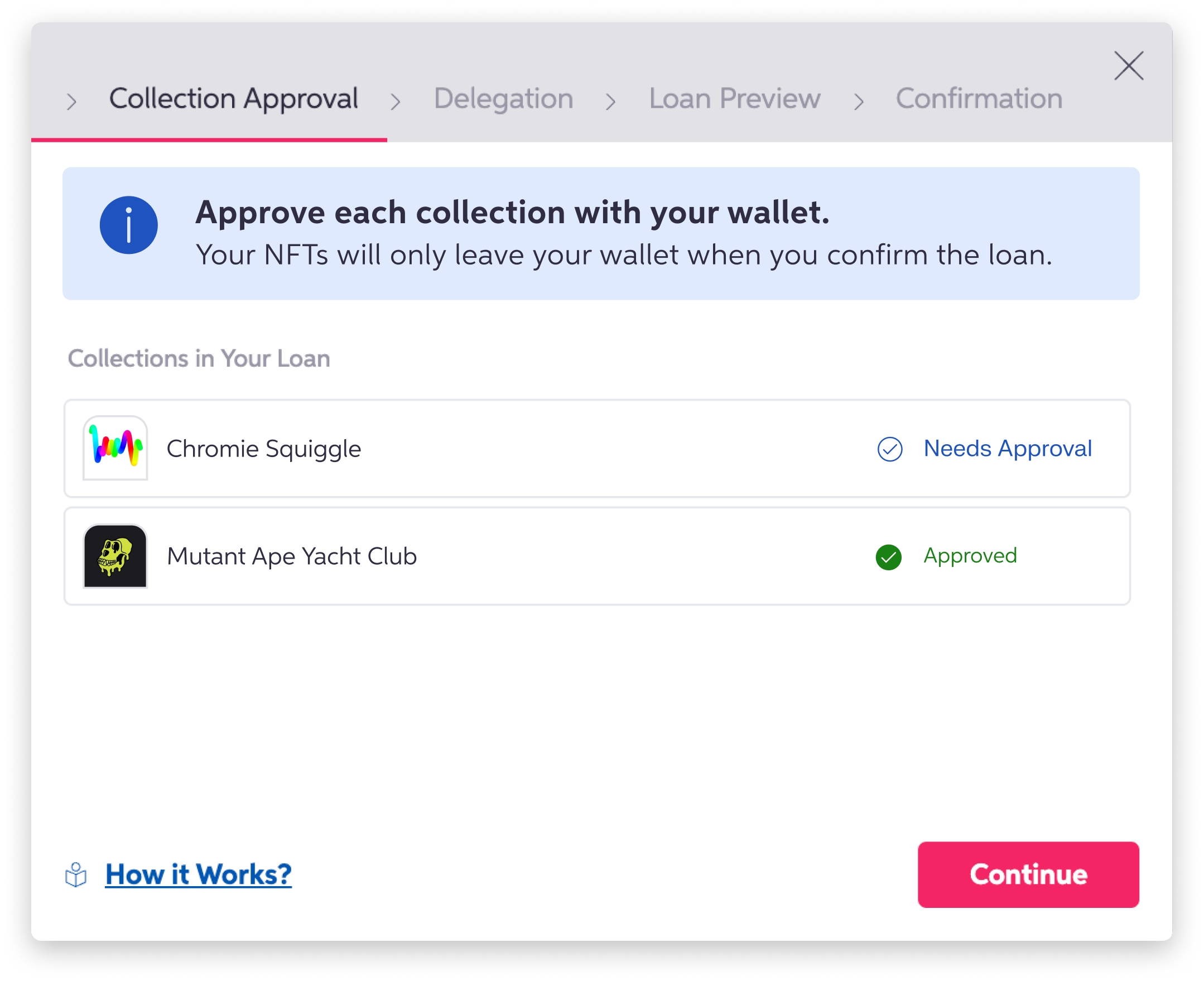

If you selected one or more NFTs from a collection you’ve never used at Zharta before, you’ll need to approve it through your wallet. You’ll only need to do this once per collection – it will appear as “Approved” in future loans.

This step is necessary so the protocol has permission to move your NFTs into a Smart Contract Escrow once you confirm the loan (your NFTs won’t be moved before then).

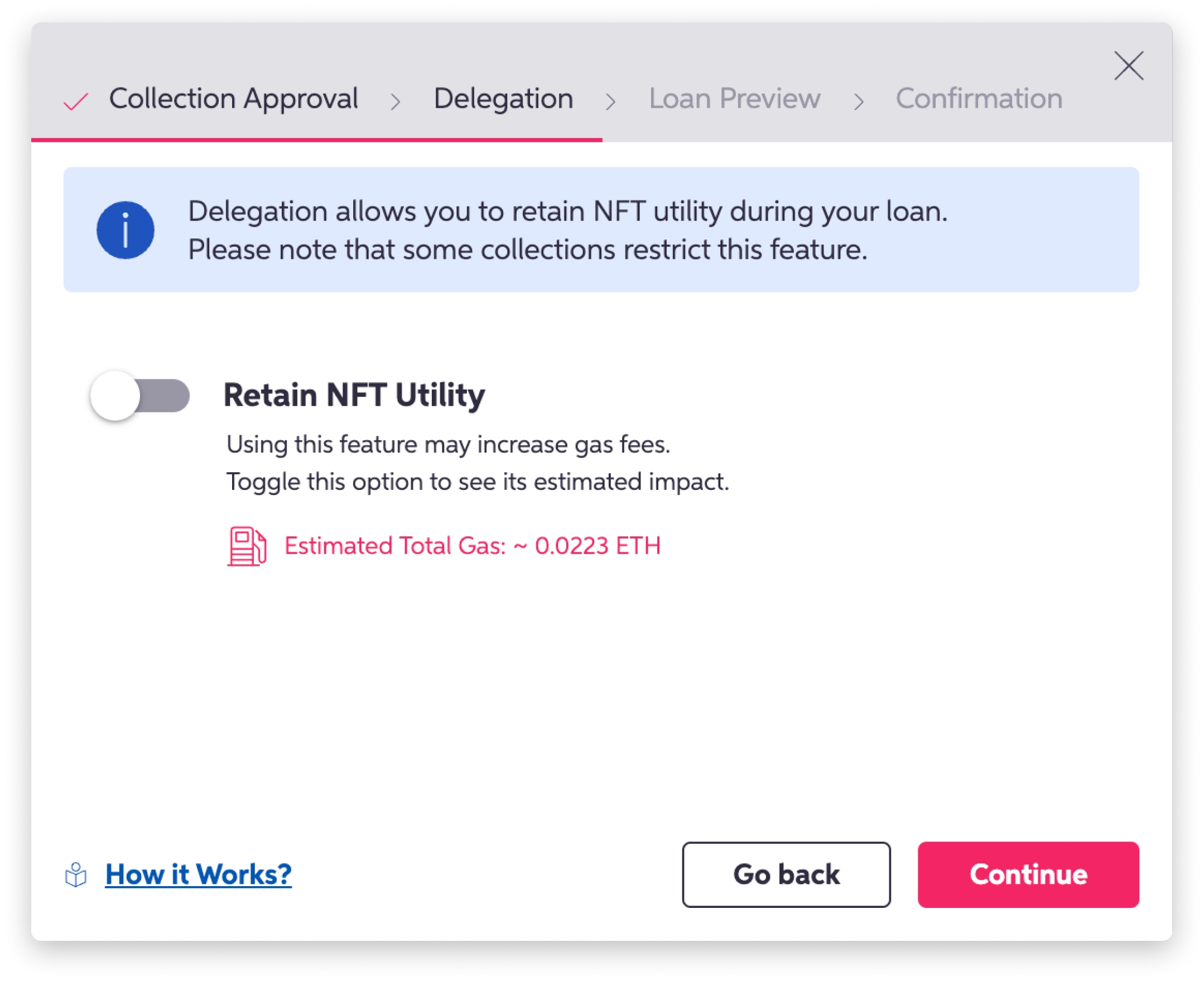

Next, you’ll decide whether you want to use Delegation.

Delegation allows you to continue to use your NFTs' utility, such as accessing gated Discord servers and using them for gaming. It's important to note that some collections may limit what you can do using Delegation.

Since this feature increases gas costs, we recommend only using it when you know you’ll need it.

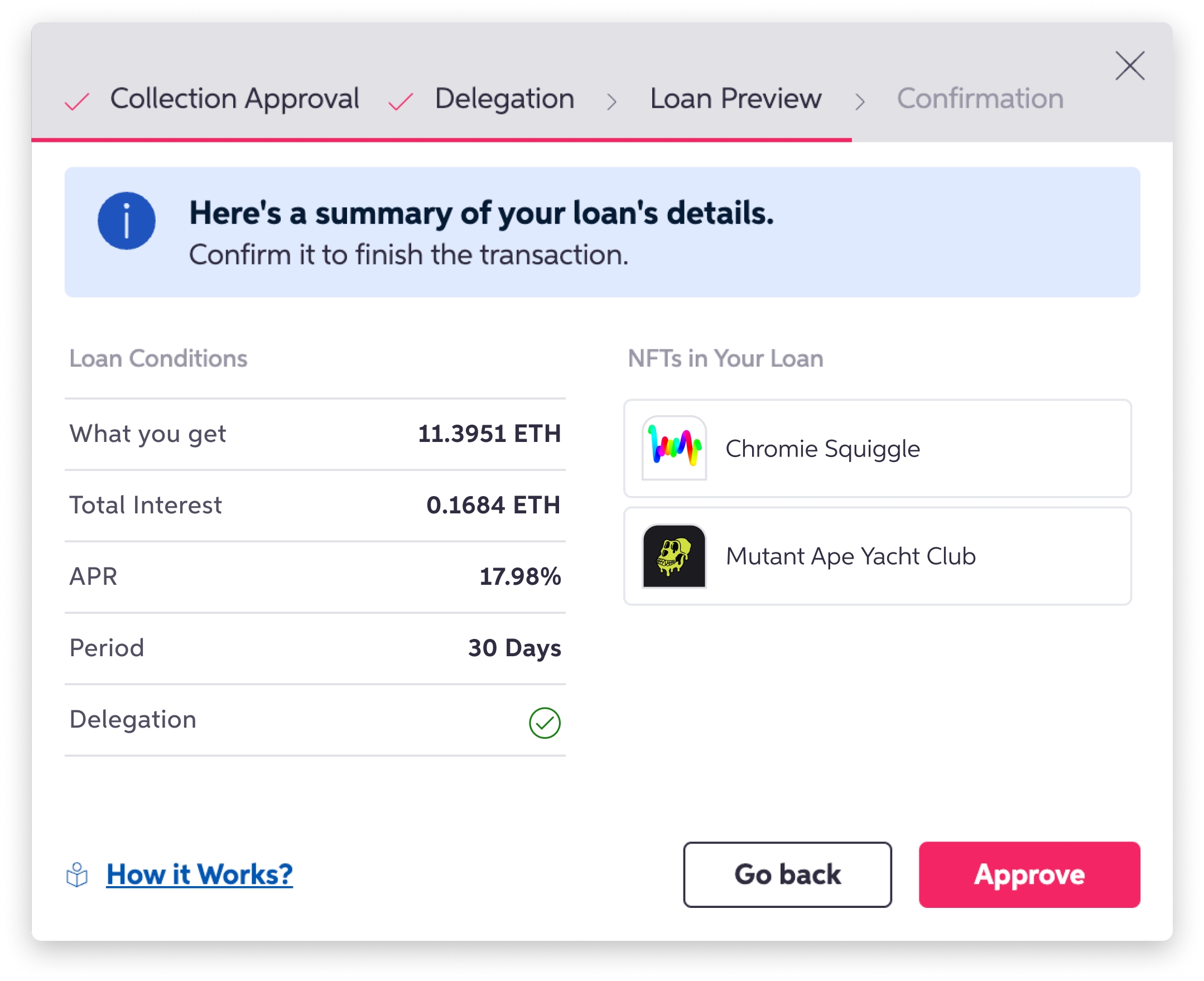

Finally, you’ll get another chance to review your loan before approving it.

Once you click Approve, you’ll be prompted to authorize it in your Wallet as well.

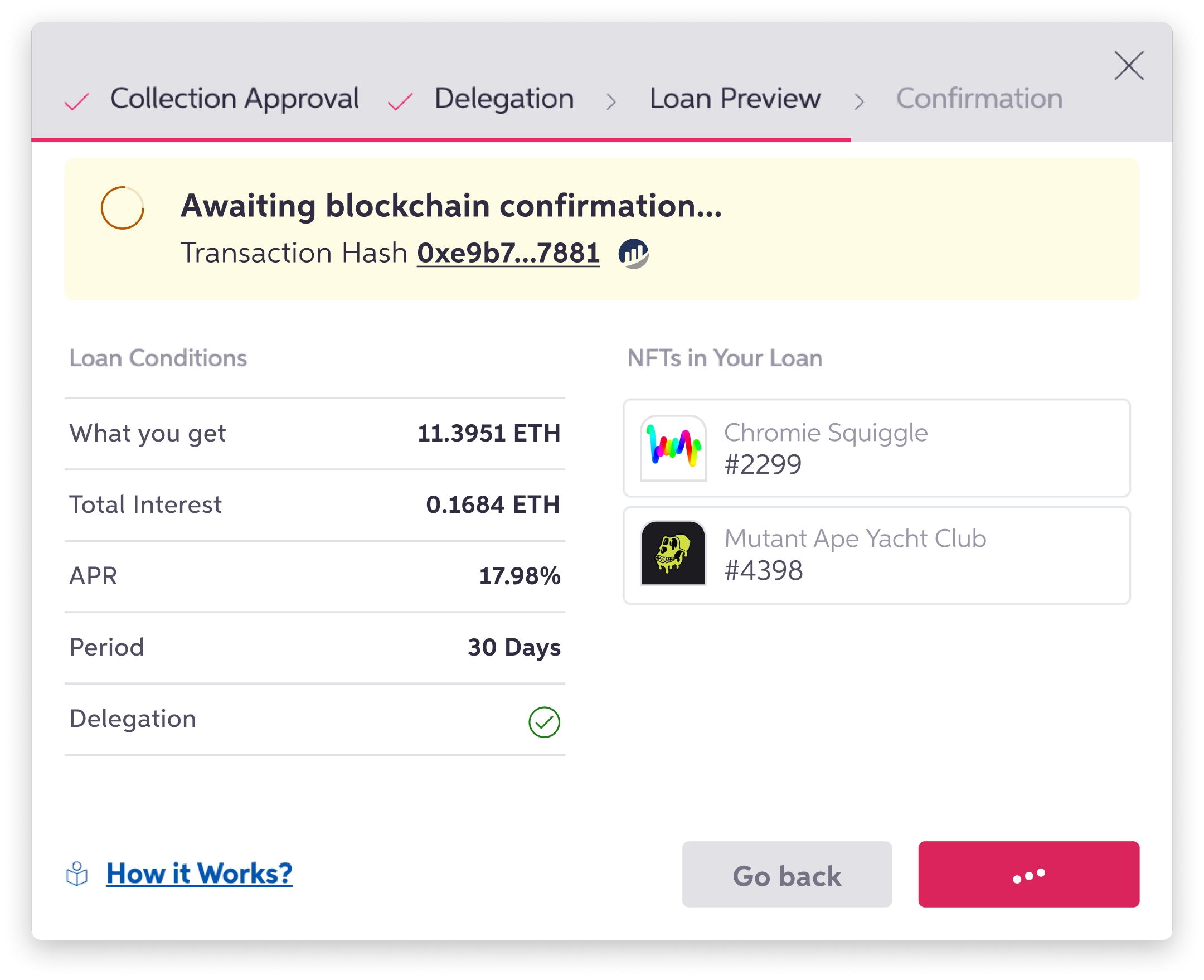

After that, just give the blockchain a moment to do its thing…

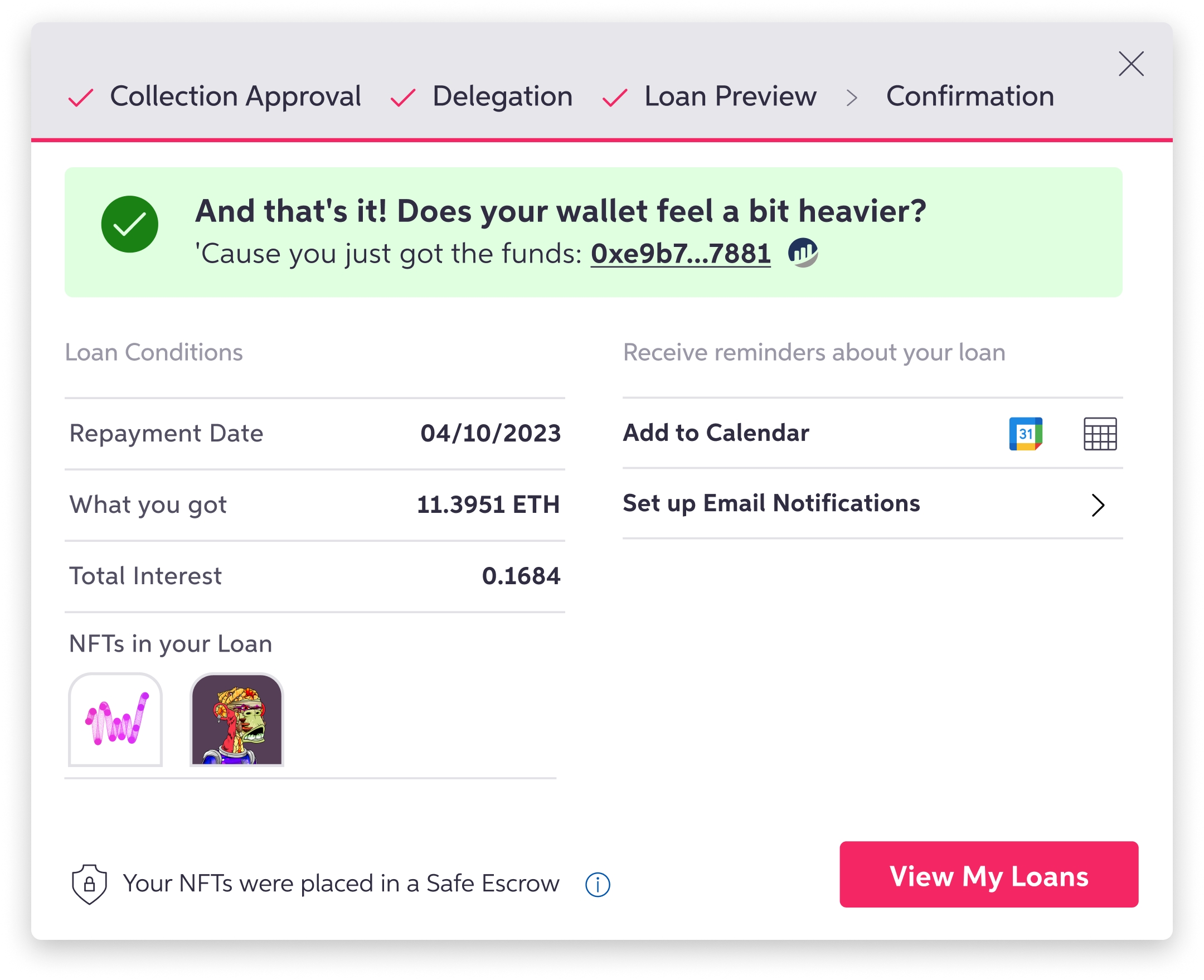

…and that’s it!

Pro-tip: You can add your email at the end of the loan flow to receive notifications about upcoming deadlines.

After this last step, the Borrower will be prompted to submit an email to receive notifications regarding the ongoing loan. This is optional but recommended. You can read additional information about this in the Notification System section.

Repaying a Loan

To make things simpler, Zharta only allows full loan repayments.

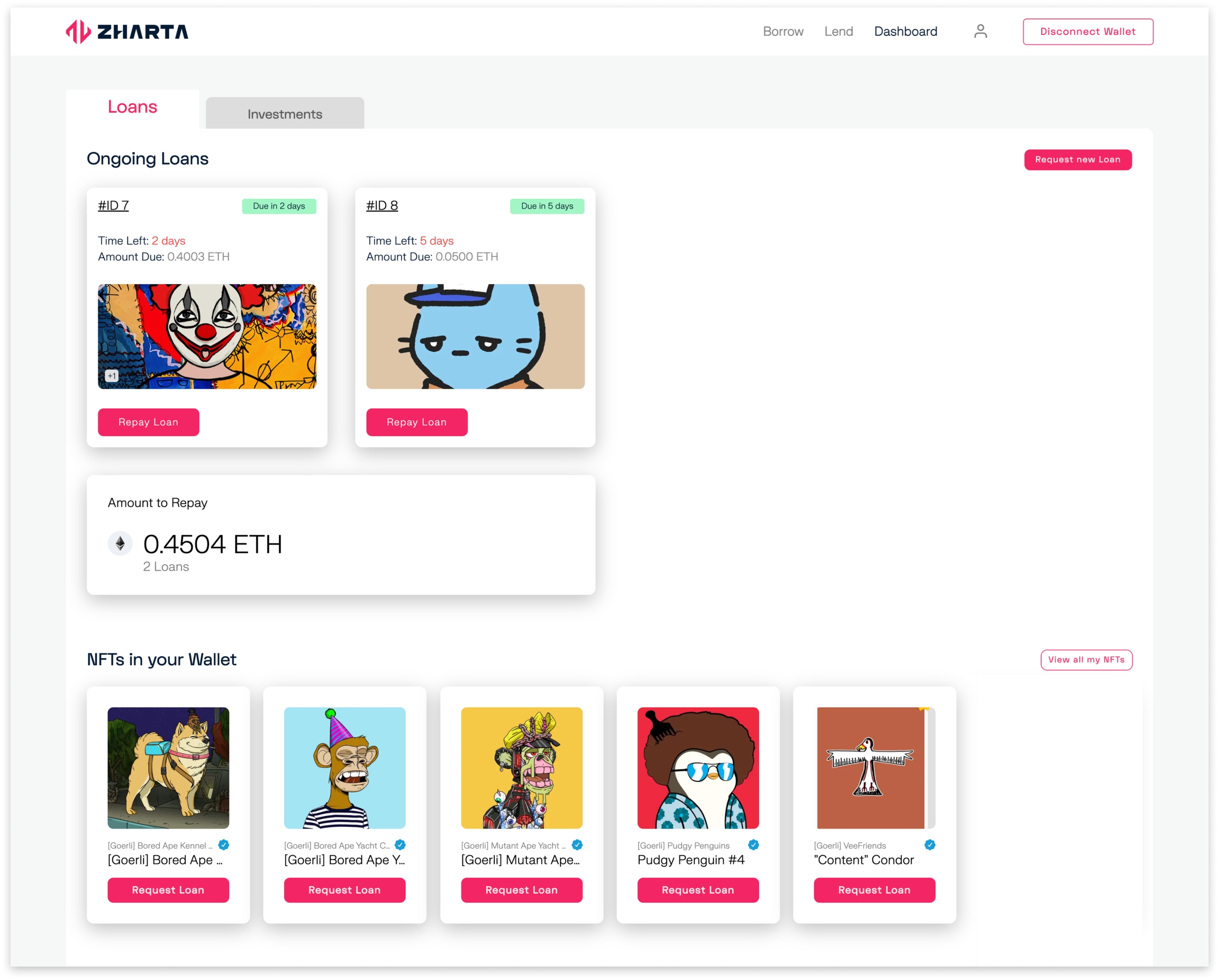

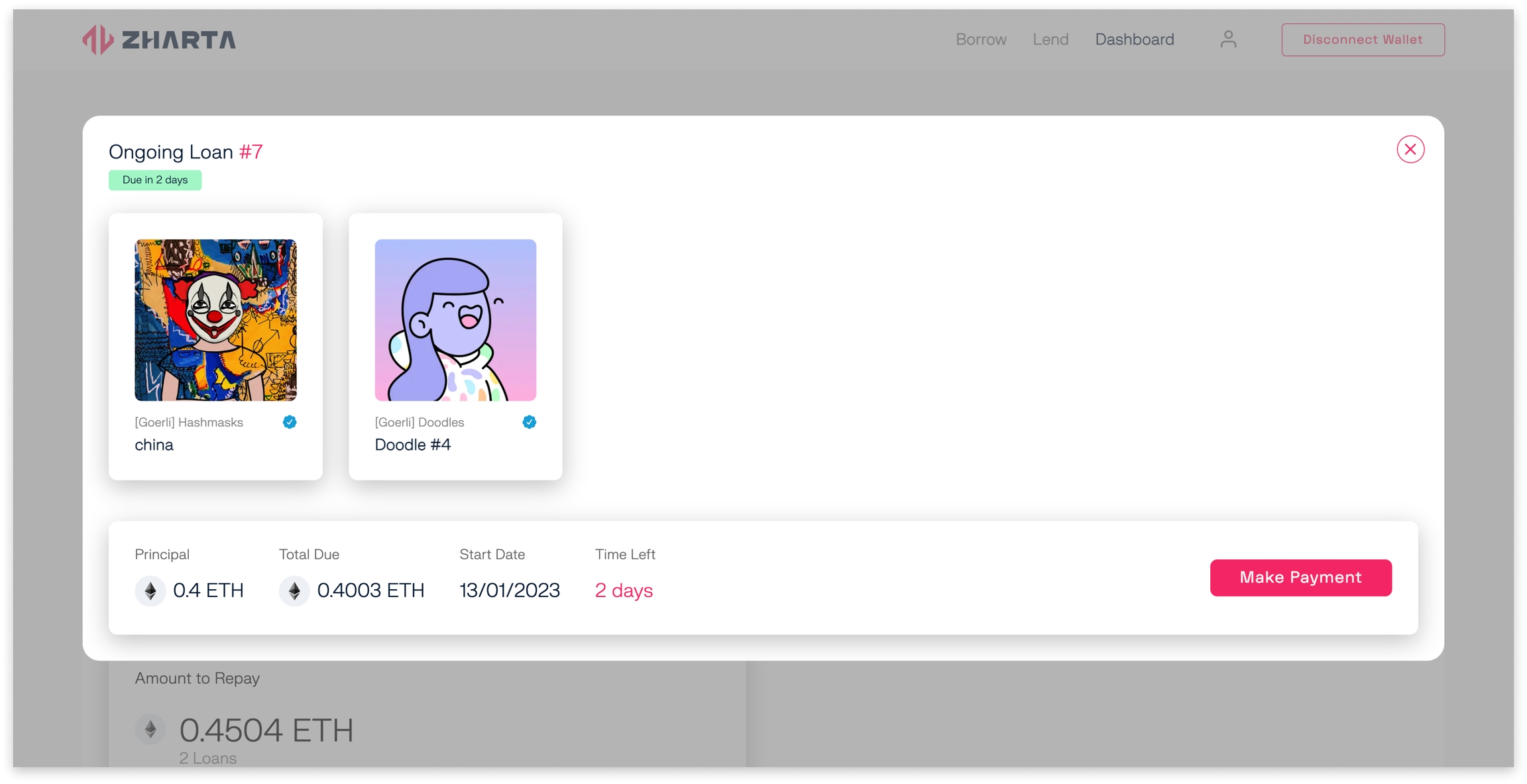

To make a repayment, go to the Loans section of the Dashboard and click on the ongoing loan you wish to repay.

Doing so will lead you to an overview of the loan in question. Double-check check this is the loan you were looking for and make your repaument.

Last updated