Grace Period

Unfortunately, defaults happen sometimes, but they are rarely the desired outcome for Borrowers. Moreover, while some defaults arise due to a real inability to repay the loan, some occur due to unforeseen circumstances, or even simple forgetfulness, delaying repayment. We recommend using our Notification System to get reminders regarding loan deadlines.

To avoid these unnecessary defaults, we provide a 48-hour Grace Period as an extra opportunity for users to repay their loans.

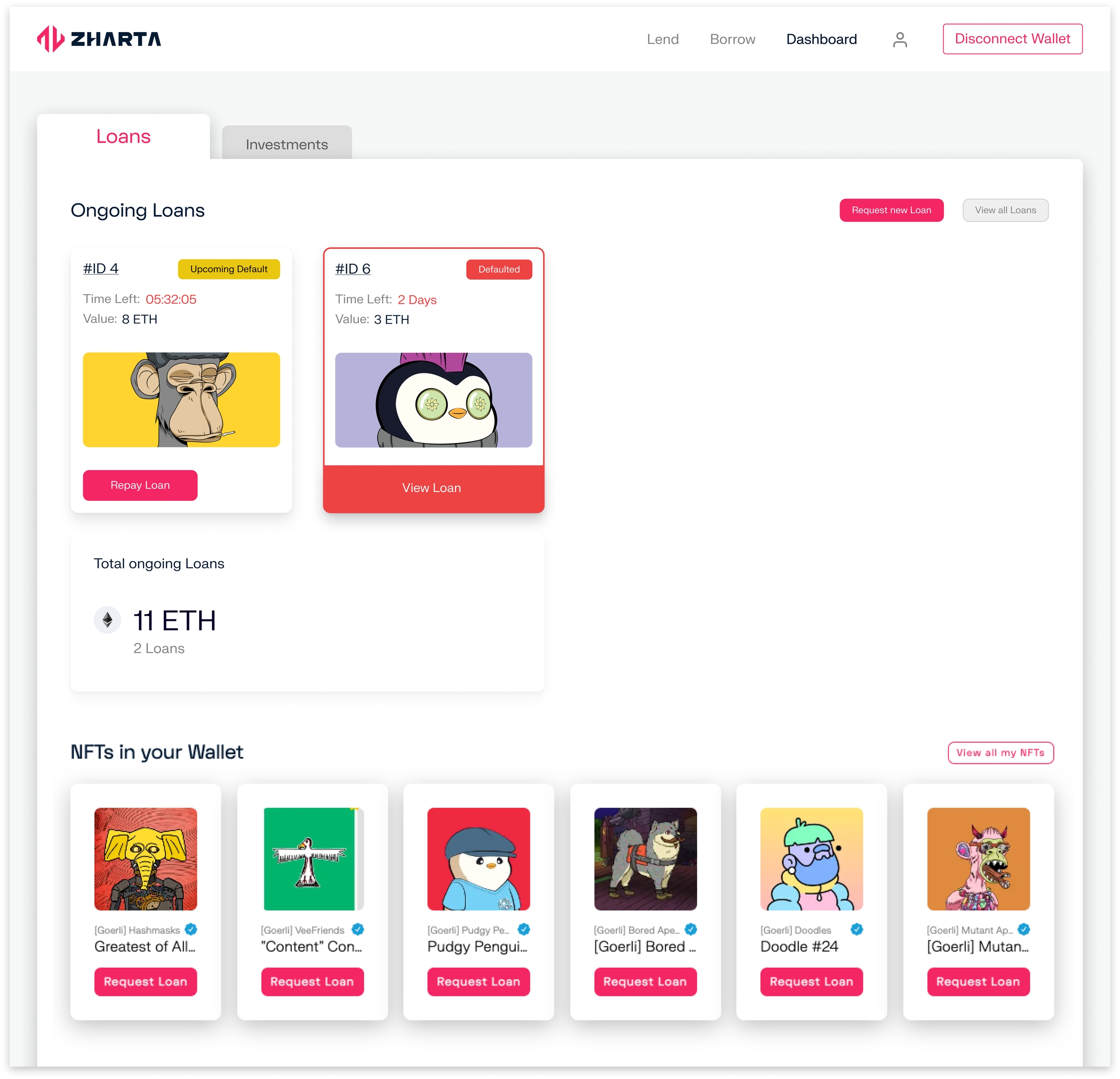

After a loan reaches maturity, it transitions to a Defaulted state (see image below). During the Grace Period, it will remain in the Ongoing Loans section, allowing the user to repay it (plus a penalty fee) to recover their assets.

During these 48 hours, the Borrower can avoid losing their collateral by repaying the amount borrowed plus accrued interest, in addition to a penalty fee for late repayment

Example: Borrower defaults on loan with 10 ETH principal and 0.3 ETH accrued interest.

Penalty fee = min(2.5% x 10 ETH, 0.20 ETH) = min(0.25 ETH, 0.20 ETH) = 0.20 ETH

Grace Period Price = 10 ETH + 0.3 ETH + 0.2 ETH = 10.5 ETH

Last updated